Broker Network Awards – Broker Network Conference 2016

We are very pleased and proud to announce that not one, but two of our colleagues at Commercial Insurance Services Ltd have made it as finalists for the prestigious Broker Network awards in separate categories. What categories they are?!

Innovation Of The Year 2016

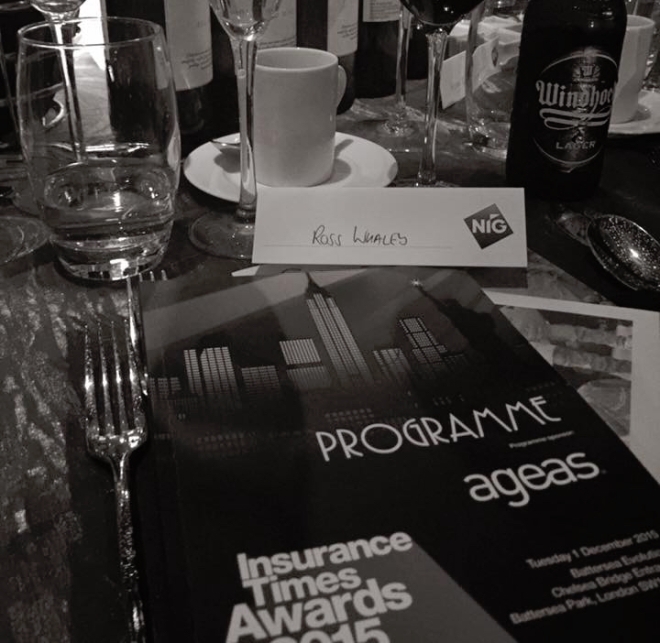

Firstly, we have our Marketing Manager Ross Whaley BA hons, who has been with the company since 2014. Pushing the boundaries of Marketing and innovation within our industry beyond what we could have ever expected. Ross’s bespoke vision and way of visually communicating, campaign after campaign, delivering the desired result every time.

A little background from Ross’s career. 3 years at a Design & Marketing College, followed by a 3 year course at a highly commended Design University. Graduating with Hons as a Graphic Designer with a true flare and passion for Design & Marketing with vast experience in B2B & B2C Marketing. He came on board with CiSL as our Marketing Manager back in 2014. Upon arrival working closely with the Managing Directors, InsureEasy was born. A vast knowledge and experience in Design, Marketing & Social Media Communication, InsureEasy soon had a clear vision and the marketing plan began to take shape.

InsureEasy an online Insurance Broker, something our industry has been crying out for since the dawn of the “Comparison Site”. InsureEasy is a site like no other, with the use of social media and online chat facilities customers are able to interact and quote for them selves, yet if they need advice it is always there with a fully qualified CERT CII broker on the other end of the screen. So for those who like to handle their Insurance online InsureEasy is there.

Rather than being bombarded to take the “Cheapest” priced policy and finding out you are uninsured, InsureEasy is laid out in such a way that clients understand their risk prior to engaging with the quote engine. InsureEasy has a had amazing success and continues to generate leads and look after it’s ever growing online community.

This not being his first final he has helped CiSL to achieve, Finalists for Broker Brand Campaign of the Year Award 2015 at The Insurance times awards, and now a finalist as Broker Innovation Of The Year for Broker Network Awards 2016.

All the best in your category Ross, we at Commercial Insurance Service are rooting for you #marketingman

Rising Star of the Year 2016

Secondly, we are very proud to have Adam Cooper CERT CII as a Finalist who has been part of the CiSL team since 2012. Starting as a young admin apprentice, his talents and passion for the Insurance Industry did not go unnoticed. Completing his apprentice scheme within record time, by the age of 17, Adam was well on the way to becoming the young broker we had hoped.

Having a natural talent for interacting with clients, Adam soon became one of the top target achievers within the renewal department at the time. Seeing this natural passion for business & the success of InsureEasy generating so many leads, Management decided to offer Adam the opportunity to become a New Business Executive. He has a natural way of building report with clients both new and existing which was exactly what the company was looking for to push InsureEasy to the next stage of its business plan.

In late 2015, 4 months into his New Business Executive role, the opportunity arose, thanks to BeWiser & Broker Network, for Adam to embark on a 12 day intensive CERT CII course. Once again Adam passed his CERT CII with flying colours and entered into 2016 fully qualified.

At the age of 20 Adams fast rise to success had not gone unnoticed. With BIBA 2016 Young Broker of the Year approaching it was given that his colleagues would nominate him for his achievements within the industry in such a short space of time. Making it all the way to the final 9 was a massive accomplishment for Adam and an absolute privilege to say he is a part of the CiSL team.

With the help of CiSL, BeWiser & Broker Network, Adam Cooper (CERT CII) has been able to begin one of the fastest ascents to success that the Insurance Industry has ever seen. Only great things will come with this young mans career, and at the young age of 21 he is showing tremendous potential.

Win or lose on the 7th October Adam is and amazing Broker to work along side and is highly appreciated within the company. Best of luck, all of your colleagues at the Commercial Insurance Service Ltd are behind you.

Closing Comment

We wish both candidates the best of luck in the running for their awards, however we would like to use this opportunity to say that we at CiSL value all of our staff, without them, Commercial Insurance Services would not exist as you know it today, and we would not have the high level of service that we pride ourselves on offering our customers. Thank you team!

*Want to know more about Broker Network Awards & the 2016 Conference. Please see below.

Celebrate the best in independent broking

The inaugural Broker Network Awards, hosted by BIBA Chief Executive Steve White, are designed to recognise and celebrate hard work, member achievements and accomplishments in a variety of different areas and will take place at our National Conference on 7th October from 4pm.

We hope that by taking part in the awards, you will feel increased levels of community spirit and be proud to be part of a Network that recognises and celebrates broker independence.

Awards Categories

- Independent Broker of the Year

- Rising Star of the Year (broker under 35)

- Growth strategy of the Year

- Industry Achiever Award

- Innovation of the Year

- Start-up Broker of the Year

- Strategic Partner Insurer of the Year

Useful Links:

WWW. BROKERNETWORK.CO.UK

WWW.CISL.CO